CMDF selection for Outsourced Chief Officer (OCIO Services)

The Capital Market Development Fund (CMDF) was founded under Section 218/2 of the 2019 Securities and Exchange Act (No.6) with aims to promote development of the Thai Capital Market with over 6 Billion Baht (approximately USD 200 Million) worth of asset. CMDF is categorized as “tax exempted” agency under Thai tax revenue’s law.

The Mandate and Objectives:

There are three major objectives for CMDF in searching for an outsourced discretionary investment manager, including:

1. Increase efficiency in investment implementation, portfolio monitoring, risk management

2. Provide value added in term of additional return (net of fee) over the benchmark via selection (security/manager) and/or tactical allocation

3. Provide advice and recommendations on various other investment policy issues, including recommendation on SAA (upon request)

Scope of Services:

1. Investment Implementation and Operations

1.1 Managing overall portfolio in accordance with SAA and investment guidelines

1.2 Determine the appropriate portfolio structure, including instruments/funds selection and/or Tactical portfolio adjustments around the strategic asset allocation to achieve the portfolio return objective on net of fee basis

1.3 Responsible for all operation including account opening for fund subscriptions (if applicable) and other tasks which related to currency risk management.

1.4 Managing overall portfolio risk, within specified risk limit

1.5 Managing overall portfolio to comply with relevant regulatory requirements

2. Portfolio Monitoring and Reporting

2.1 Monitor the performance of the overall portfolio, asset class, and funds relative to respective benchmarks

2.2 Provide ongoing monitoring and oversight of investments in portfolio to ensure compliance with laws and regulations, investment & Risk policies, and investment & risk guideline

2.3 Monitor and evaluate investment costs including, but not limited to, underlying manager fees and transaction costs

2.4 Prepare reports to the CMDF, including monthly performance reports and quarterly meeting for portfolio strategy & performance presentations

3. Client Services

3.1 Coordinate effectively with the Committee, CMDF, and custodian bank

3.2 Respond to inquiries by the CMDF in a timely manner

3.3 Report significant changes in the company ownership, organizational structure, key personnel, investment process, and other areas that may be relevant to CMDF Portfolio on a timely basis

4. Other Services

4.1 Provide advice and recommendations on investment policy issues, including recommendation on SAA (upon request)

4.2 Provide research on capital markets, economic conditions or any other topics that may relevant to Portfolio Investment which may benefit to CMDF

Period of Services:

CMDF will mandate the selected qualified investment managers to engage in a contract in relation to the service for a period of three (3) year following the date the contract is signed.

Requirement for Proposal Preparation:

The investment managers must prepare the proposals in two (2) parts:

(1) Part I : Technical Proposal

The Technical Proposal should address all questions set forth in the Questionnaire and provide all data in the Template accompanying this RFP. If the investment managers desire to provide additional information beyond those requested in the Questionnaire, they may do so by adding in the Appendix to the Technical Proposal. The investment managers may send an electronic file of the Technical Proposal together with the Template (in an “.xls” format) in 2 separate files via e-mail to the following email address : Treasury&InvestmentManagementDepartment@set.or.th

(2) Part II: Fee Proposal

The Fee Proposal should be filled in Fee Template provided. Please note that Fee Proposal must be password encrypted before sending out. The investment managers may send an electronic file of the Fee Proposal via e-mail to the following email address : Treasury&InvestmentManagementDepartment@set.or.th

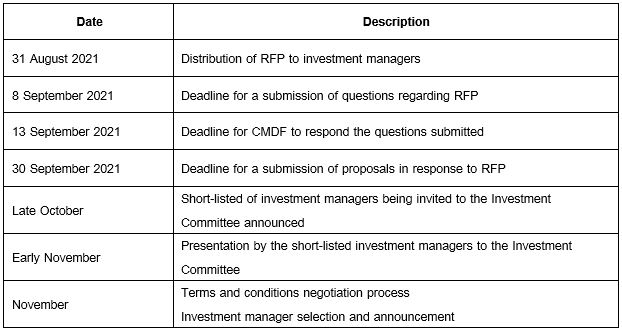

Timeframe:

Without any commitment, the following schedule has been set tentatively by the Committee and may be changed if necessary.

Contacts:

All inquiry and questions regarding RFP should be submitted to:

Treasury&Investment Management Department

The Stock Exchange of Thailand Building, 17F,

93 Ratchadapisek Rd., Dindang,

Bangkok 10400 Thailand

Email : Treasury&InvestmentManagementDepartment@set.or.th